In the past, insurance coverage for sports camps and clinics was either too costly, too limited or not available at all. Schools, coaches and directors were either forced to pay extremely high insurance premiums, or to run camps and clinics without the proper insurance protection, therefore running the risk of personal exposure to lawsuits or a participant's injury claim.

RYZER and the Nicholas Hill Group have developed this specialty camp insurance program to cover the inherent risks involved for the schools, park districts, coaches, directors and participants of today’s sports camps and clinics. Accident and liability insurance coverage is offered as a standard product with optional coverage also available such as equipment, hired and non-owned automobile, and additional higher liability insurance limits.

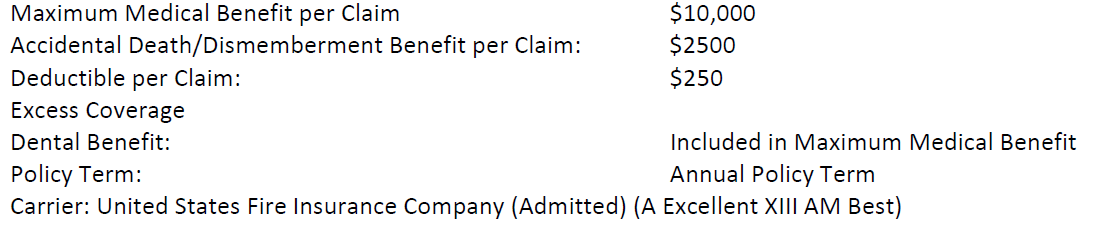

THE ACCIDENT COVERAGE

$25,000 BENEFIT

(Pays the medical bills of an injured student or staff member)

MEDICAL EXPENSE BENEFIT

If the Covered Person incurs eligible expenses as the direct result of a covered injury and independent of all other causes, the Company will pay the charges incurred for such expense within 365 days, beginning on the date of the accident. Payment will be made for eligible expenses in excess of the applicable $100 Deductible Amount, not to exceed the Maximum Medical Benefit.

The first such expense must be incurred within 90 days after the date of the accident.

"Eligible expense" means charges for the following necessary treatment and service, not to exceed the usual and customary charges in the area where provided.

Medical and surgical care by a physician

Radiology (X-rays)

Prescription drugs and medicines

Dental treatment of sound natural teeth

Hospital care and service in semiprivate accommodations, or as an outpatient

Ambulance service from the scene of the accident to the nearest hospital

Orthopedic appliances necessary to promote healing

Excess coverage: This plan does not cover treatment or service for which benefits are payable or service is available under any other insurance or medical service plan available to the Covered Person.

ACCIDENTAL DEATH AND DISMEMBERMENT BENEFIT

Benefit amount is $10,000. If a covered injury results in any of the losses specified below within 365 days after the date of the accident, the Company will pay the applicable amount:

Full Principal Sum for loss of life

Full Principal Sum for double dismemberment

Full Principal Sum for loss of sight of both eyes

50% of the Principal Sum for loss of one hand, one foot, or sight of one eye

25% of the Principal Sum for loss of index finger and thumb of same hand

"Member" means hand, foot, or eye. Loss of hand or foot means complete severance above the wrist or ankle joint. Loss of eye means the total, permanent loss of sight.

We will not pay more than the Principal Sum for this Benefit for all losses due to the same accident.

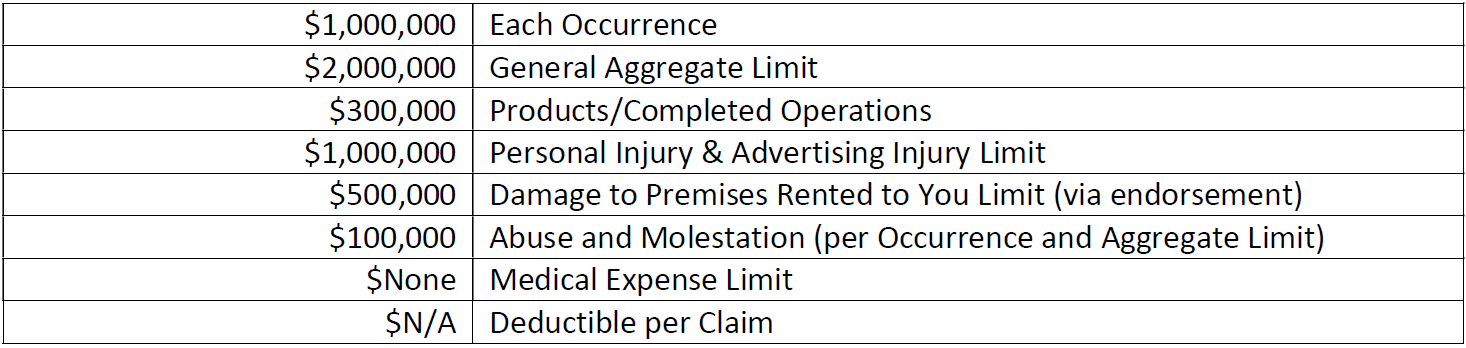

THE LIABILITY COVERAGE

$1,000,000 COVERAGE

(Protects you in the event of a lawsuit or property damage)

WHO IS COVERED

This $1,000,000 occurrence form general liability program provides protection for your Camp, Clinic or Conference’s owners, directors, instructors, and employees against claims of bodily injury liability, property damage liability, personal and advertising injury liability, and the litigation costs to defend against such claims. There is no deductible amount for this coverage. Coverage is offered through the Specialty Insurance Purchasing Group, pursuant to the Federal Risk Retention Act of 1986.

COVERAGE INCLUDES SUITS ARISING OUT OF:

Injury or death of participants

Injury or death of spectators

Injury or death of volunteers

Property damage liability

Host liquor liability (nonprofit)

General negligence claims

All activities necessary or incidental to conduct of activities

Cost of investigation and defense of claims, even if groundless

Ownership, use, or maintenance of gyms, fields, or practice areas

Additional Insured parties may be added at no charge.

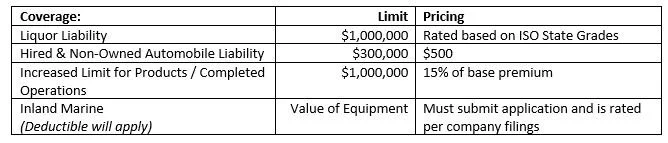

THE OPTIONAL COVERAGES

HIRED AND NON-OWNED AUTOMOBILE LIABILITY COVERAGE

This liability coverage provides protection for rented, borrowed and other non-owned vehicles driven on camp, clinic or conference business (note: no coverage for transportation of athletes).

Abuse and molestation coverage

Available limits are $25,000 & $100,000 if all 4 qualification questions are answered yes (we reserve the right to request a copy of the written procedures). Increase to $1M is available subject to mandatory review of written procedures and underwriter approval.